On Tuesday night, 11 May 2021, Federal Treasurer Josh Frydenberg handed down his third Federal Budget. In a pre-COVID world, we were told to celebrate “Back in Black” surpluses. Those days are now gone. But so too, are the economic deficits forecast during the height of COVID-19. The underlying deficit for the 2020-21 year will be $161.0 billion (that is $52.7 billion less than expected and forecast only 6 months ago). The forecast deficit for the 2021-22 financial year is $106.6 billion with forward estimates suggesting a deficit of $57 billion by 2024-25 (nearly one-third of the deficit in 2020-21).

The Australian economy outperformed all major advanced economies for 2020. Real GDP has been resilient. The unemployment rate has not blown out as perhaps expected. In fact, the unemployment rate is expected to fall below 5% by 2023. Confidence is also continuing in the equity and property markets.

Key budget measures that will impact on our clients include:

- Continued access to low income tax offsets and lower tax rates for individuals;

- The extension of the temporary full expensing of assets until 30 June 2023; and

- The extension of the loss carry-back rules for companies also to 30 June 2023.

We’ve outlined below some of the main tax measures that were announced in the Budget.

As with all budgetary measures, these measures are not final until the relevant legislation has been passed by the Government. We will keep you updated on the status of any proposed measures.

Superannuation guarantee - minimum earnings threshold abolished

The Government is proposing to remove the current $450 per month minimum income threshold, under which employees do not have to be paid the superannuation guarantee by their employer. It is expected this will take effect from 1 July 2022.

This measure will benefit taxpayers with lower income. It is estimated that around 300,000 individuals will receive additional superannuation guarantee payments each month, 63% of whom are women.

Low and Middle Income Tax Offset

The Low and Middle Income Tax Offset (LMITO) will remain for the 2021-22 income year. This provides a tax rebate of up to $1,080 for individuals or $2,160 for couples.

Individual income tax rates

There were no changes announced to the individual tax rates as these tax cuts were brought forward in the October 2020 budget and backdated to 1 July 2020.

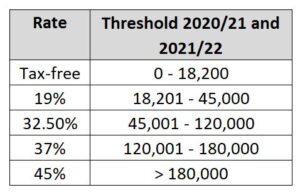

The table above shows the tax thresholds for the 2021 and the 2022 financial years.

For companies with a turnover of less than $50 million, the company tax rate will drop to 25% from 1 July 2021 (down from 26% in the 2021 financial year). This is a tax cut was implemented by an earlier budget.

Deduction for depreciable assets

The temporary full expensing of assets will be extended to 30 June 2023.

As such, from 6 October 2020 to 30 June 2023 businesses with a turnover up to $5 billion can deduct the full cost of eligible depreciating assets of any value in the year they are first used or installed ready for use.

Loss carry-back for companies

The loss carry-back provisions for companies have been extended to the 2022-23 financial year. Companies that make a loss in the 2019-20, 2020-21, 2021-22 and/or 2022-23 financial year can carry this loss back to reduce taxable profits made on or after 2018-19. The company can elect to receive a refund of the tax paid when lodging the later year tax return. This measure will enable companies to take advantage of full expensing of depreciating assets while it is available.

Superannuation contributions

Work test – abolished

It is proposed that from 1 July 2022, the work test will be abolished for voluntary non-concessional or salary sacrifice superannuation contributions. This will enable taxpayers aged between 67 and 74 to make more non-concessional contributions to superannuation. Individuals aged between 67 and 74 will still have to meet the work test to make personal deductible contributions.

Downsizer contributions – expanded

The eligible age for the downsizer superannuation contributions will also be reduced to 60 (currently 65). As such, taxpayers aged 60 or older, will be able to make a one-off post-tax contribution to their superannuation of up to $300,000 per person from the proceeds of selling their home. Both members of a couple can contribute in respect of the same home, and contributions do not count towards non-concessional caps.

Other changes commencing 1 July 2021

While not part of the budget, a reminder of the following changes that will commence from 1 July 2021:

- The superannuation guarantee rate increases to 10%;

- The concessional superannuation cap increases to $27,500;

- The non-concessional superannuation cap increases to $110,000 per annum or $330,000 over 3 years;

- The total superannuation balance limit increases to $1.7 million.

Individual tax residency rules

The Government is proposing to replace the existing individual tax residency rules with a new framework. The primary test will be a simple, ‘bright line’ test – a person who is physically present in Australia for 183 days or more in any income year will be an Australian resident. Individuals who do not meet the primary test will be subject to secondary tests that depend on a combination of physical presence and measurable, objective criteria.

The budget papers acknowledge that Australia’s current tax residency rules are difficult to apply in practice, creating uncertainty and resulting in high compliance costs for individuals and their employers.

Self education expenses

The Government is proposing to remove the exclusion of the first $250 of deductions for prescribed education costs. Currently, the first $250 of a prescribed course of education expense is not deductible. Removing the $250 exclusion will reduce compliance costs for individuals claiming self-education expense deductions

Increased powers of AAT

The Government is proposing to increase the powers of the Administrative Appeals Tribunal to pause or modify ATO debt recovery action in relation to disputed debts that are being reviewed by the Small Business Taxation Division of the AAT.

SME Recovery Loan Scheme

The Government is proposing to support the economic recovery of businesses affected by COVID-19 or flood.

The Government will provide participating lenders with a guarantee for 80% of secured or unsecured loans of up to $5 million for a term of up to 10 years with interest rates capped at 7.5%.

To be eligible, SMEs (including self-employed individuals and non-profit organisations) will have a turnover of up to $250 million and have either been:

- recipients of the JobKeeper Payments between 4 January 2021 and 28 March 2021; or

- located or operating in a local government area that has been disaster declared as a result of the March 2021 New South Wales floods and were negatively economically impacted.

Other measures of interest

Some other measures of interest from a tax perspective include:

- A Digital Games Tax Offset to provide a 30% refundable tax offset for qualifying Australian digital games expenditure from 1 July 2022.

- A tax rate of 17% for income from eligible medical and biotechnology patents. Consultation will be undertaken to see if the concession will be extended to income from clean energy patents.

- Increased Child Care Subsidy from 11 July 2022.

- $506.3 million will be provided to extend the JobTrainer Fund. This is estimated to deliver 163,000 additional low fee and free training places in areas of skills need (including 10,000 places of digital skills courses).

- An additional $2.7 billion over four years will be applied to expand the Boosting Apprenticeship Commencements wage subsidy to support businesses and Group Training Organisations to take on new apprentices and trainees.

- A new Family Home Guarantee with 10,000 places from 2021-22 to support single parents with dependants to enter, or re-enter, the housing market with a deposit of as little as 2%.

We will keep you up-to-date with the progress of the implementation of these Budget measures.

If you would like to discuss the tax implications of the budget proposals, please call us on (07) 56656469.

DISCLAIMER: The information in this article is general in nature and is not a substitute for professional advice. Accordingly, neither TJN Accountants nor any member or employee of TJN Accountants accepts any responsibility for any loss, however caused, as a result of reliance on this general information. We recommend that our formal advice be sought before acting in any of the areas. The article is issued as a helpful guide to clients and for their private information. Therefore it should be regarded as confidential and not be made available to any person without our consent.

Jeanette has over 20 years experience as an accountant in public practice. She is a Chartered Accountant, registered tax agent and accredited SMSF Association advisor. When she is not helping business owners grow their empires, you will likely find her out running on the trails or at the gym. Book in to see Jeanette today.