|

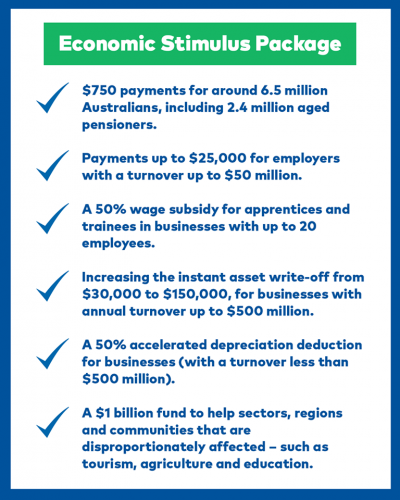

Businesses that withhold tax on employees’ salary and wages will receive a payment equal to 50 per cent of the tax withheld on wages up to a maximum payment of $25,000. The minimum payment an employer will receive is $2,000 (even if they are not required to

withhold tax on employee wages).

The “payment” from the Government will be recorded initially as a credit to the business upon lodgement of their activity statement. If

this places the business in a refund position, the ATO will deliver the refund within 14 days.

Quarterly BAS lodger – example

If you lodge your BAS quarterly, and you employ staff, you will be eligible for a credit against your March 2020 and June 2020 BAS

equal to half of your PAYG withholding obligations (up to a total of $25,000).

For example, if you reported PAYG withholding of $4,570 in your March 2020 BAS and $5,000 in your June 2020 BAS, you will receive a credit of $2,285 against your March 2020 BAS (50% x $4,570) and $2,500 against your June 2020 BAS (50% x $5,000).

Alternatively, if you reported PAYG withholding of $57,000 in your March 2020 BAS and $55,000 in your June 2020 BAS, you will

receive a credit of $25,000 against your March 2020 BAS (although 50% of your PAYG withholding for the March quarter is $28,500

you can only claim a maximum credit of $25,000). In the June 2020 BAS you will not be entitled to any credit as you reached the

$25,000 cap in the March 2020 quarter.

Monthly BAS lodger – example

If you lodge your BAS monthly, and you employ staff, you will be eligible for a credit against your March 2020, April 2020, May 2020

and June 2020 BAS. To ensure monthly lodgers receive the same benefit as the quarterly lodgers, the March 2020 BAS will be

multiplied by 3 and then half of this will be credited.

For example, if you withhold $5,000 per month for your employees, in March, you will be eligible for a credit of $7,500 ($5,000 per

month x 3 months x 50%). In April, May and June, you will be eligible for a credit of $2,500 per month.

Employers without PAYG withholding

Some employers do not need to withhold tax for their employees as they are below the tax-free threshold. That is, the employer is

required to lodge a BAS and report their gross wages but do not have any PAYG withholding. In this situation, the employer will still

receive a minimum payment from the Government of $2,000.

|