Now is the time for you to review your 2022 estimated tax position to see what action can be taken prior to 30 June to minimise your tax liability.

There are quite a few new issues to consider for the 2022 financial year. We have outlined some of the key 2022 tax planning ideas for you below.

There are also some significant changes taking effect from 1 July 2022. We have also outlined these changes here.

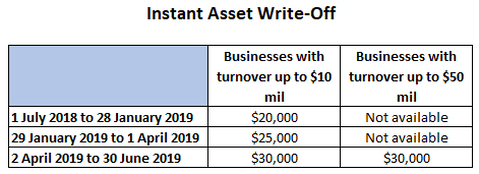

Depreciation of assets

For businesses with a turnover under $50 million, up to 30 June 2022 you can claim a deduction for the acquisition of any eligible depreciating assets (there is no limit for most assets).

For small businesses (turnover under $10 million) that use simplified depreciation rules, the balance of your small business pool can be written off at the end of the income year.

We note that there is still a cost limit on certain assets – for example, you can only claim a maximum deduction of $60,733 for a passenger vehicle during the 2022 financial year. A passenger vehicle is a vehicle that is designed to carry a load less than one tonne and fewer than 9 passengers.

EOFY Tax tip: If you are looking to acquire capital assets for your business, we recommend doing so prior to 30 June to get the deduction in the current financial year. If the deduction puts your company in a loss position – consider the loss carry-back provisions below.

Business tip: While you get the benefit of deducting the full cost of the asset in the current financial year, this means that you will not receive any depreciation on this asset in future years. It also means that when you sell the asset, any income from the sale will be subject to income tax.

Business tip: The tax depreciation deduction is only available once the asset is installed and ready for use. Getting assets installed and ready for use by 30 June might be difficult for some businesses given the current lack of supply for equipment and vehicles.

Company loss carry-back

Companies that make a loss in the 2020 to 2023 financial years, can carry this loss back to reduce taxable profits made on or after the 2019 financial year. The company can then elect to receive a refund of the tax paid in that year when lodging the later year tax return.

EOFY Tax tip: Your company may be able to take advantage of the asset depreciation rules to write off the full value of new assets purchased. If the depreciation puts your company into a loss, this loss may be applied against the taxable profits from 2019, 2020 or 2021. You may then receive a refund of tax paid in those financial years.

Employee superannuation guarantee

The June quarter superannuation guarantee liability is required to be paid by 28 July. However, a business can only claim a tax deduction for employees’ superannuation when it is actually paid. As such, to ensure you get a deduction in the current year, you need to pay your employees’ June superannuation guarantee liability prior to 30 June (cashflow permitting). We recommend that the payment be made by 14 June (to ensure it is processed by the recipient superfund).

EOFY Tax tip: Pay your employee June quarter superannuation by 14 June 2022 to get a deduction in the current financial year.

Business tip: The ATO are currently allocating considerable resources to reviewing employer compliance with paying employees’ superannuation guarantee. There are significant penalties that can be incurred if you pay your employee superannuation late.

Business tip: The payment of your June quarter superannuation liability does not impact on your profit and loss position (as the superannuation liability has already been recorded in your profit and loss). The payment before 30 June simply brings the tax deductibility of the payment forward to the current financial year. If you make the payment after 1 July (and before the 28 July cut-off), the payment will be deductible next financial year.

Business tip: From 1 July 2022, the superannuation guarantee rate increases to 10.5%. This will continue to increase by 0.5% per year until it reaches 12%. This will have flow-on implications for payroll tax, workcover etc. The $450 minimum threshold for the payment of the superannuation guarantee will also be abolished from 1 July 2022, meaning that superannuation is payable on the first $1 of your employee’s wages.

Personal superannuation

You may also want to make personal contributions to super. For the 2021/22 financial year, the maximum concessional (deducted) contribution is $27,500.

However, if your superannuation balance was less than $500,000 as at 30 June 2021, it may also be possible for you to contribute more super by taking advantage of the unused concessional cap carry forward rules.

EOFY Tax tip: If you have unusually high income during the 2022 financial year, consider whether making additional deductible superannuation contributions fits within your personal financial plan. We recommend speaking with your financial adviser with regards to your superannuation contributions.

Trade debtors

You should review your trade debtors as at 30 June. You must ensure that any debts that are uncollectible are written off prior to 30 June in order to claim a tax deduction for the write-off in the current financial year. This is particularly important given the on-going effect of COVID-19 on many businesses.

EOFY Tax tip: To write off a bad debt – you must have made reasonable and commercial attempts to recover the debt and have now determined it is uncollectible. You then need to make a decision in writing to write off the bad debt (eg. you have removed the debt from the customer’s account and have recognised a bad debt expense).

Prepay or bring forward your expenses

Make sure you review all of your expenses and bring forward any expenses to June (where possible). For example, stock up on stationery and office consumables, prepay your insurance and interest (if applicable) and look at any other expenses you may be able to pay in June. By bringing these expenses forward to June, you are obtaining a tax deduction in the current financial year which will reduce your overall tax bill for the 2022 year.

EOFY Tax tip: If your business is in a loss position, it may not be advantageous to bring forward expenses to the current financial year. Please contact us to discuss whether this strategy is appropriate for you.

Defer assessable income

Consider whether it is possible to defer your assessable income (being mindful of cashflow implications) to next financial year.

Motor vehicles

If you are using a vehicle for a high percentage of work-related travel, make sure you keep a logbook. Without a logbook, an individual is limited to claiming a maximum of 5,000km at $0.72 (or $3,600) in the 2022 financial year. If you keep a logbook, you can claim the business percentage of the operating costs of the vehicle (petrol, registration, servicing, depreciation, interest etc).

EOFY Tax tip: A logbook started prior to 30 June can be used to support a logbook claim even if the logbook isn’t completed until after 30 June.

Working from home

If you worked from home during the 2022 financial year, you may be able to claim a deduction for a percentage of the running costs of your home. There are a few different methods you can use to calculate your deduction:

(1) Shortcut method ($0.80 per hour) – available until 30 June 2022 and covers all home office running expenses including telephone, electricity, depreciation, internet, computer consumables

(2) Fixed rate method ($0.52 per hour) – this claim only covers depreciation of office furniture and furnishings, electricity and repairs (so you can claim telephone, internet, equipment depreciation and computer consumables separately)

(3) Actual cost method – you can calculate and claim the work-related portion of your actual expenses provided you have kept appropriate records

EOFY Tax tip: The ATO have calculators that may assist you to calculate your working from home deduction shortcut method calculator and fixed rate method calculator

EOFY Tax tip: The ATO have announced that work-related expenses and working from home deductions will be a specific area of review for the 2022 tax returns.

Trust minutes

Prior to 30 June, make sure the trustees of your discretionary trusts decide how they are going to distribute their income and capital. This decision must be documented in a trust minute before 30 June. It is important that you review your trust income for the 2022 financial year to ensure that the trust minute accurately reflects the trustee’s intention. There have been recent announcements from the ATO with regards to the distribution of income to adult children and other tax advantaged beneficiaries. It is important that you get tax advice for your end of year tax minutes.

EOFY Tax tip: Your trust minutes must be prepared prior to 30 June to evidence the trustees decision regarding the distribution. Keep this minute with your tax records.

Rental properties

For your rental properties, if you have any expenses coming up in the next few months, try to pay these prior to 30 June – this will bring the deduction into the current tax year and will help you to reduce your 2022 tax bill.

EOFY Tax tip: Consider getting a depreciation report for your rental property. You may be able to claim additional tax deductions for the the cost of the building and potential its fixtures and fittings.

EOFY Tax tip: Consider undertaking repairs to your property prior to 30 June.

Cryptocurrency

The ATO have specifically announced that they will be reviewing cryptocurrency transactions in the 2022 tax returns. It is important to ensure you include all cryptocurency transactions on your tax return. If you have had any cryptocurrency gains in the current financial year, you may wish to consider some additional tax planning measures before 30 June to reduce any tax liability.

EOFY Tax tip: Make sure you have all of your documentation available for all cryptocurrency transactions. Noting that changing your investment from one cryptocurrency to another constitutes a transaction which may result in a tax liability.

DISCLAIMER: The information in this article is general in nature and is not a substitute for professional advice. Accordingly, neither TJN Accountants nor any member or employee of TJN Accountants accepts any responsibility for any loss, however caused, as a result of reliance on this general information. We recommend that our formal advice be sought before acting in any of the areas. The article is issued as a helpful guide to clients and for their private information. Therefore it should be regarded as confidential and not be made available to any person without our consent,

Jeanette has over 20 years experience as an accountant in public practice. She is a Chartered Accountant, registered tax agent and accredited SMSF Association advisor. When she is not helping business owners grow their empires, you will likely find her out running on the trails or at the gym. Book in to see Jeanette today.