Rental Properties

Getting the Best Tax Outcome in 2024

To get the best tax outcome from your rental property, we recommend paying any upcoming expenses before 30 June.

Any deductible expense that is paid prior to 30 June can be claimed in this financial year. If you pay the same expense after 30 June, it can’t be claimed as a deduction until next financial year.

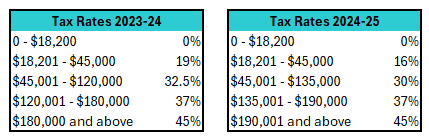

With the individual tax rates decreasing after 30 June 2024, you will get an even bigger advantage in paying your rental property expenses prior to 30 June (as a deduction is worth more in the 2024 year than the 2025 year). For example, a $5,000 expense will get you a $125 greater tax deduction in 2024 than in 2025:

2024 year deduction

$5,000 repairs

Paid before 30 June

Individual earning $120,000

Repair total (deduction) = $5,000

Tax refund (2024 return) = $1,625

Net out of pocket = $3,375

2025 year deduction

$5,000 repairs

Paid before 30 June

Individual earning $120,000

Repair total (deduction) = $5,000

Tax refund (2025 return) = $1,500

Net out of pocket = $3,500

Rental expenses

For rental properties, examples of some of the deductible expenses you might be able to pay before 30 June include:

- Repairs and maintenance

- Cleaning

- Gardening

- Pest control

- Smoke alarm review and maintenance

- Servicing costs – eg. air conditioner, pool

Have a chat with your property manager to see if there are any expenses that can be paid prior to 30 June.

Depreciation

We also recommend getting a depreciation schedule for your property. Contact a qualified quantity surveyor to prepare a depreciation schedule for your property (for example – BMT Tax Quantity Surveyors or Deppro). The cost of the report can be claimed as a deduction and the report will also provide you with the details of the depreciation you can claim in your tax return.

What should you do now?

- Talk to your property manager about any expenses that you can pay for your property prior to 30 June;

- Book in any relevant services now to ensure that they are completed and paid prior to 30 June (keep a valid tax invoice for all services that you want to claim as a tax deduction);

- Contact a quantity surveyor to get a depreciation report for your property;

- Start compiling records for the expenses already paid for your property during this financial year.

DISCLAIMER: The information in this article is general in nature and is not a substitute for professional advice. Accordingly, neither TJN Accountants nor any member or employee of TJN Accountants accepts any responsibility for any loss, however caused, as a result of reliance on this general information. We recommend that our formal advice be sought before acting in any of the areas. The article is issued as a helpful guide to clients and for their private information. Therefore it should be regarded as confidential and not be made available to any person without our consent.

Jeanette has over 20 years experience as an accountant in public practice. She is a Chartered Accountant, registered tax agent and accredited SMSF Association advisor. When she is not helping business owners grow their empires, you will likely find her out running on the trails or at the gym. Book in to see Jeanette today.